IAS 37 Provisions, Contingent Liabilities and Contingent Assets

With an accrual, the amount of the transaction, whether it is an expense or revenue, is already known beforehand — the company just hasn’t received or paid the monies yet. This form of accounting is commonplace in many business, and conforms to the provisions of the generally accepted accounting principles, or GAAP. Companies use this system to prepare their financial statements for its external stakeholders. Whereas a reserve is part of a business’s profit, a provision is intended to cover upcoming liabilities, set aside to improve the company’s financial position through growth or expansion. Companies may have different provisions, such as building provision for depreciation, Provision for future loss on the sale of assets, and provision for debtors, which can be expected to go bad and doubtful.

The interest expense recorded through an adjusting journal entry will be the amount that was accrued as of the year-end date. If bonuses do not accrue on a pro-rata basis management will have to estimate the number of employees that will still be employed at the bonus payment date and a provision will have to be recognised. Contingent assets are possible assets whose existence will be confirmed by the occurrence or non-occurrence of uncertain future events that are not wholly within the control of the entity.

- In such a case, if we apply the Accrual Principle, then the company will record this financial transaction in its books in the first quarter itself.

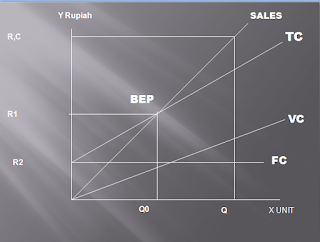

- The main objective of provisioning is to make the balance sheet more accurate in an accounting period or financial year.

- In contrast, provision aims to protect the business from a heavy cash outflow in the future and make provision for any un-probable event.

- Accruals impact a company’s bottom line, although cash has not yet exchanged hands.

The terms allowance for doubtful accounts and provision for obsolete inventories have been in our vocabularies for decades—at least those of us trained in the days before IFRS was born. The Provision means to keep some money for a known liability which is probable to arise after a certain time. The Reserve is to retain some money from the profit to for any particular future use. The amount of provision cannot be used to pay off dividends, but the amount of the reserves can be used for so.

Accounts Payable

The Accrual Principle is a concept in Accounting where the financial transactions are recorded during the same time period in which they occur, however the actual cash flow may occur at a later stage. For example, suppose a company supplies goods worth $50,000 in the first quarter of financial year, but the company receives the payment in the second quarter. In such a case, if we apply the Accrual Principle, then the company will record this financial transaction in its books in the first quarter itself.

Charge against profit refers to the expenses that have to be paid irrespective of profit and loss of the firm. In general terms a provision is made against the book value of an asset, whereas an accrual is made to ensure known income and costs are accounted for in the period to which they relate. • Accruals are made for expenses already known and expected to materialize in the future, whereas provisions are made for expected future losses, so that these losses may be recovered from the provisions kept aside. A Provision is an amount that is set aside to cover a probable future expense.

Difference Between Accrual and Provision

Thus, the identification of the person from whose account income tax was deducted at source is a prerequisite condition so as 6 steps of mbo to make the provision for Chapter XVII-B workable. Tax deducted at source is considered to be tax paid on behalf of the person from whose income the deduction was made and, therefore, the credit for the same is to be given to such person. This would involve debiting the “expense” account and crediting the “accounts payable” account. Accruals are liabilities to pay for goods or services that have been received or supplied but have not been paid, invoiced or formally agreed with the supplier, including amounts due to employees. Accruals include accounting for several expenses such as purchase of materials, payment of utility expenses such as rent, electricity, professional fees etc. Example – M/s XYZ has a long outstanding debtor – M/s ABC that stands in the books.

If the entity for example has a history of paying bonuses every year and by doing so created a valid expectation that they will continue to pay annual bonuses, they have a constructive obligation to pay bonuses. Capitalized interest is the cost of borrowing to acquire or construct difference between provision and accrual a long-term asset, which is added to the cost basis of the asset on the balance sheet. Accruals improve the quality of information on financial statements by adding useful information about short-term credit extended to customers and upcoming liabilities owed to lenders.

A liability is a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. We offer a broad range of products and premium services, includingprintand digital editions of the IFRS Foundation’s major works, and subscription options for all IFRS Accounting Standards and related documents. Every purchase contributes to the independence and funding of the IFRS Foundation and to its mission.

Some examples of accruals may include receivables, accounts payable, accrued rent, and so on. Its accountant records a deferral to push recognition of this amount into a future period, when it will have provided the corresponding services. Contingent liabilities also include obligations that are not recognised because their amount cannot be measured reliably or because settlement is not probable.

The objective of accruals is to report the correct numbers of revenue and expense for that period and forecast certain receivables and payables. In contrast, provision aims to protect the business from a heavy cash outflow in the future and make provision for any un-probable event. In general, the rules for recording accruals are the same as the rules for recording other transactions in double-entry accounting. The specific journal entries will depend on the individual circumstances of each transaction.

Accrued revenues are those that the company has already earned, but has not received cash for. Accrued expenses, on the other hand, are the expenses that have been incurred, but cash has not physically been paid out. Accruals are made for the expenses or revenue that are already known by the firm, and are recorded in the financial statements as and when they occur, before the exchange of cash and funds take place. This form of accounting ensures that all financial information including sales on credit and end of month interest to be paid are recorded for the period.

Businesses that use the cash accounting system do not have to be particular about the year and record the expenses whenever they occur. There may be several circumstances which can result in an additional expense or a loss for the business. These circumstances may not be predictable with certainty but owing to the possibility of a loss occurring, a provision is created in the books in line with the accounting principle of prudence. This is a significant accounting problem because it presents an incorrect financial picture of the company. A write-off primarily refers to a business accounting expense reported to account for unreceived payments or losses on assets.

Recording Accruals on the Income Statement and Balance Sheet

To record accruals on the balance sheet, the company will need to make journal entries to reflect the revenues and expenses that have been earned or incurred, but not yet recorded. For example, if the company has provided a service to a customer but has not yet received payment, it would make a journal entry to record the revenue from that service as an accrual. This would involve debiting the “accounts receivable” account and crediting the “revenue” account on the income statement. This would involve debiting the “accounts receivable” account and crediting the “revenue” account on the income statement.

The Provisions are expected and uncertain, whereas accrual is certain, probable, and easily foreseen. Accrual and provision are made before the reports of the company are reported. We support the development, adoption, and implementation of high-quality international standards.

The use of accrual accounts greatly improves the quality of knowledge on monetary statements. An enterprise shall accurately account for all its transactions actually taken place in order to provide reports of reliable quality on the economic andfinancial activities of the enterprise itself . Many fixed assets are portable enough to be routinely shifted within a company’s premises, or entirely off the premises. That which is stipulated in advance; a condition; a previous agreement; a proviso; as, the provisions of a contract; the statute has many provisions.

IAS plus

An accrual means accounting for a liability that is certain and due but yet to be actually paid. Accrual essentially means accounting for an expense that has been incurred but has yet to be settled by a business. This article looks at meaning of and differences between two types of accounting for expenses – accruals and provisions.

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. An example of an expense accrual entails employee bonuses that had been earned in 2019, but won’t be paid till 2020. A cash flow statement is an accounting statement that reflects the condition of cash receipts and cash disbursements of an enterprise during a certain accounting period. A statement of changes in financial position is an accounting statement that reflects comprehensively the sources and application of working capital and its changes during an accounting period .

Ledger BalanceA ledger balance is an opening balance that remains available during the start of each business day. It comprises of all the deposits and withdrawals, used in the calculation of the total funds left in an account at the end of the previous day. Revenue is the amount of money that a business can earn in its normal course of business by selling its goods and services. In conclusion, first consider whether a bonus obligation meets the definition of a liability before considering whether it should be recognised as a liability or a provision. The amount of a 13th cheque bonus is easy to determine but estimates will be necessary to determine the amount of a performance based bonus which will most likely result in a provision being recognised.